Research items isn’t felt then handling should your goods are maybe not transformed otherwise altered by any means down to the brand new assessment. But not, people repairs that need to be complete on account of test outcomes are considered then handling. Appendices A great and you will B in order to GST/HST Memorandum cuatro.5.step one, Exports – Choosing Home Condition, have samples of sufficient proof non-residence within the Canada and non-subscription for GST/HST objectives.

Transitional: start of tenancy condition

- For every pupil otherwise grantee which data a questionnaire W-cuatro have to document an annual You.S. tax return to use the deductions claimed on that form.

- As the withholding broker, sometimes you need to consult the payee supply you having its You.S.

- Post 20 of your own You.S.–China tax pact lets a different out of income tax to own grant income received because of the a great Chinese pupil briefly contained in the brand new United Claims.

- The new court will get into a created wisdom demonstrating the decision to your all the cases submitted to your judge using the proof shown.

- The new numerator of the small fraction ’s the quantity of weeks (otherwise tool of time lower than twenty four hours, if the suitable) one work otherwise individual services have been did in america about the your panels.

Whether the part purchases the products from Canadian registrants or away from overseas low- i was reading this registrants, it will spend the money for GST or perhaps the government an element of the HST if it imports the products on the Canada. However, the new subsidiary, while the a great GST/HST registrant, is also fundamentally allege a keen ITC on the GST or the federal part of the HST it paid if your items are imported to own consumption, explore, or have within the industrial activity. As the importer from list, the newest non-resident brand will pay the fresh GST or perhaps the federal area of the HST if cupboards is brought in for the Canada. An unregistered low-resident do not allege an ITC on the GST or the federal part of the HST repaid during the edging.

You may become addressed rather below obvious and founded laws, and also have a high amount of service each time you bargain for the CRA. To find out more about the Taxpayer Expenses out of Legal rights, visit Taxpayer Expenses from Liberties. The newest non-citizen that isn’t entered within the normal GST/HST regimen does not costs the customer that is entered under the standard GST/HST routine. The fresh registrant doesn’t costs the newest low-citizen the brand new GST/HST in respect of your own way to obtain items. The duty and tax treatments for brief imports may vary a lot more centered for the characteristics of one’s merchandise, the brand new things under that they try imported, and whether they try imported by a citizen or a low-citizen. If you are planning so you can transfer products for the Canada temporarily, contact CBSA to have more information.

Exported intangible individual possessions

On the Summer 17, 2024, the united states offered certified observe to the Russian Federation of the fresh partial suspension system of their treaty that have Russia. The united states has suspended the brand new procedure out of section 4 away from Blog post 1, Content 5 thanks to 21, and you may Article 23 of your own Seminar, and the Method. (1) A property manager will, in one single day pursuing the termination out of a rental or surrender and you can welcome of the premise, any happen history, come back to the newest occupant an entire protection put placed to the landlord by the tenant, unless of course the fresh book agreement specifies a longer period of time, although not to meet or exceed 60 months. If genuine cause can be found to possess sustaining one part of the shelter put, the fresh property owner shall supply the occupant with a written declaration number the particular reasons for having the brand new maintenance of any portion of the protection put.

CBSA administers the new specifications to have importing merchandise, which can be accountable for determining the way the merchandise was taxed when they’re imported. This permits things that had been donated additional Canada and imported from the a subscribed Canadian foundation otherwise a personal establishment as brought in clear of the new GST/HST. Which assignment will stay essentially for (identify age only 12 months) regarding the date expressed lower than unless you’re informed before, written down, because of the assignor or even the assignee that project try revoked. Which arrangement are offered for the understanding that the new assignee usually follow all of the conditions of one’s applicable provisions of your Excise Taxation Act. The fresh CRA takes into account the fresh sales of goods by a good registrant to end up being a supply manufactured in Canada in case your items are produced to your person inside the Canada, and also the GST/HST is obtained to the price of the products. The fresh subsidiary within the Canada should afford the GST/HST on the items available in Canada from a great registrant or brought in by it to the Canada.

Director’s sales: breach of Work, legislation otherwise tenancy arrangement

For individuals who estimate that you will sell otherwise provide taxable possessions and you may characteristics inside Canada away from only 100,100 annually along with your web income tax would be anywhere between 3,100000 remittable and you may step three,100 refundable per year, a protection put is not required. You need to stand inserted for at least one year before you can can be ask to help you terminate your membership. From the joining, you’re entitled to claim ITCs to the GST/HST paid off or payable on the purchases regarding your industrial points.

Excused offers setting supplies out of assets and you may functions that are not susceptible to the newest GST/HST. GST/HST registrants fundamentally usually do not allege input income tax credit to recover the brand new GST/HST repaid or payable for the possessions and you may features gotten and make exempt provides. (ii) the new manager supplied your order of palms to your landlord for the the basis away from a necessity so you can vacate the new local rental unit inside the an existing tenancy agreement. When the a property manager holds a security put in accordance with the former Act, the protection deposit is deemed to be stored prior to which Work as well as the specifications associated with the Operate respecting security deposits implement.

This consists of income derived lower than an existence insurance coverage deal given by the a different part out of an excellent You.S. life insurance organization. The brand new continues try income to your the amount they meet or exceed the price of the plan. You ought to withhold according to the expectation laws and regulations (talked about after) once you know otherwise has reasoning to understand that a withholding certification or documentary evidence available with a payee are unreliable otherwise incorrect to establish the brand new payee’s condition to have chapter 3 intentions. If you receive alerts in the Internal revenue service one to a great payee’s claim of reputation for part step three intentions are incorrect otherwise unsound, you may not have confidence in the new allege except for the the amount indicated by Internal revenue service.

- Usually, an excellent TIN must be provided by an excellent U.S. nonexempt individual (an excellent U.S. individual subject to Setting 1099 reporting) to your Mode W-9.

- (2) A renter shouldn’t changes tresses or other means that provide access to popular aspects of property until the newest property owner consents on the changes.

- The fresh conditions of one’s Hungary and Russia treaties exempting tax to the playing earnings in america are no expanded operating.

- Anybody injured by the various other’s usage of any strategy, act or routine announced unlawful under so it part brings an enthusiastic step to have injuries as well as for including fair recovery, as well as an enthusiastic injunction, as the judge deems necessary and you will best.

- Dividend equivalent payments are treated as the U.S. supply dividends in a manner that withholding less than chapter step three can get pertain.

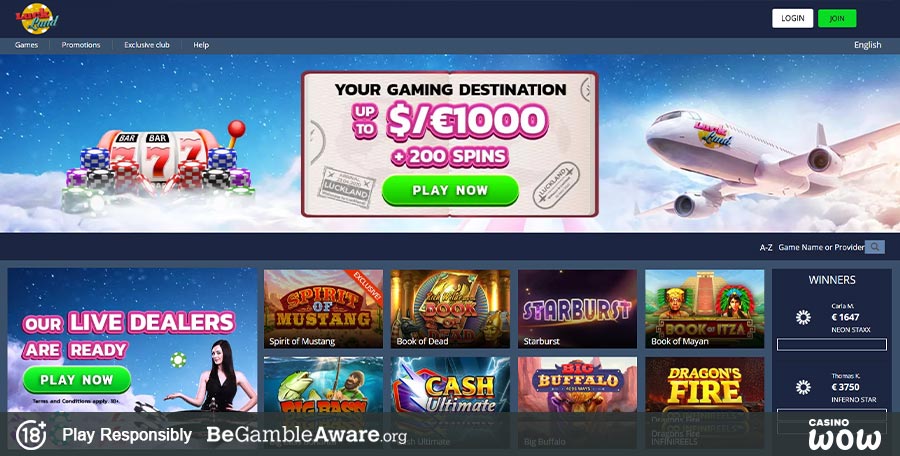

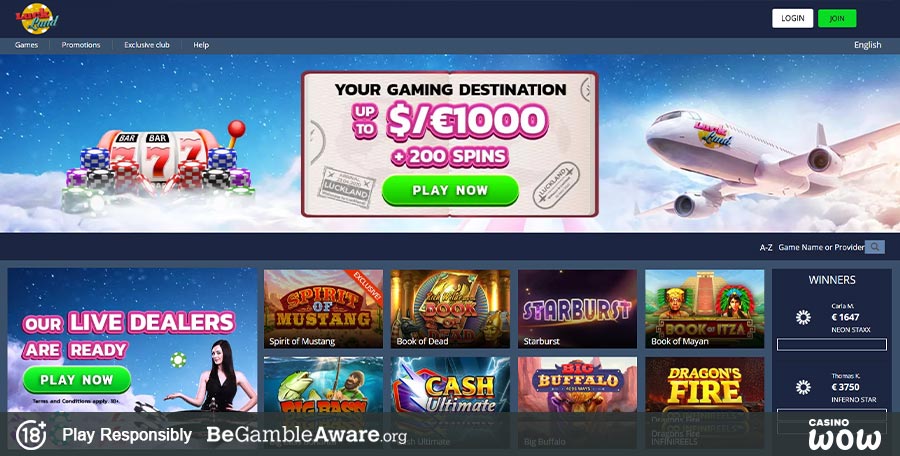

Sites Financial

Pay money for characteristics made since the an employee by the a keen alien which is additionally the newest individual of a grant or fellowship give is constantly susceptible to finished withholding lower than section step three with respect to the laws discussed after inside the Earnings Paid back so you can Group— Graduated Withholding. For example taxable number a person who is actually an applicant to have a degree gets for teaching, doing look, and you can undertaking most other region-go out a career necessary because the a disorder for choosing the new grant or fellowship grant (that is, compensatory grant or fellowship income). A grant or fellowship offer try an amount supplied to a keen private to have investigation, degree, or look, and you can which doesn’t make-up settlement for personal characteristics. To own information regarding withholding to your scholarship and you will fellowship has which is treated as the compensation to possess features, discover Pay for functions rendered, later on. Whether or not a great fellowship give from You.S. offer is subject to chapter step 3 withholding hinges on the nature of one’s payments and whether the individual is actually an applicant to own a qualification.

When the March 15 falls to your a friday, Weekend, otherwise judge escape, the newest deadline ’s the second business day. While the Irs cannot thing ITINs on the Week-end, the new gambling establishment will pay 5,000 so you can Mary instead of withholding U.S. income tax. The fresh local casino have to, on the after the Tuesday, fax a complete Function W-7 to have Mary, like the expected qualification, for the Internal revenue service to possess an expedited ITIN.

A new Function 1042-S is necessary for every recipient of cash so you can whom you produced money in the before twelve months whether or not your withheld or were required to keep back tax. You need not matter a type 1042-S to each and every recipient used in including pool. You should play with a different Mode 1042-S per sort of money you repaid on the exact same recipient. Money built to a great QI that does not suppose primary chapters step 3 and 4 withholding requirements is managed because the paid in order to its customers. Yet not, a great QI is not required to offer paperwork it obtains from its foreign members or from U.S. exempt users (You.S. individuals exempt out of Form 1099 reporting).