Allowance for doubtful accounts is not a temporary account as they get carried forward to the next financial year. It helps them acknowledge the risks inherent in collecting on account and present more realistic AR figures. In turn, these figures help CFOs efficiently project budgets and plan working capital needs. As much as you would love to collect on every invoice you issue, that doesn’t always happen. Problems such as disputes, miscommunications, and customer insolvency make achieving a 100% collection rate challenging.

For those of you using manual accounting journals, you’ll have to make appropriate entries to your journals to manage ADA totals properly. As a small business owner, you take a giant leap of faith every time you extend credit to your customers. Even with the most stringent analysis of a customer’s ability to pay, there’s going to be a time when a customer (or two) doesn’t pay what they owe. Bad Debt Expense increases (debit), and Allowance for Doubtful Accounts increases (credit) for $22,911.50 ($458,230 × 5%). Let’s say that on April 8, it was determined that Customer Robert Craft’s account was uncollectible in the amount of $5,000.

Estimation Techniques of Allowance for Doubtful Accounts

You’ll notice that because of this, the allowance for doubtful accounts increases. A company can further adjust the balance by following the entry under the „Adjusting the Allowance“ section above. Note that the debit to the allowance for doubtful accounts reduces https://www.bookstime.com/articles/allowance-for-doubtful-accounts the balance in this account because contra assets have a natural credit balance. Also, note that when writing off the specific account, no income statement accounts are used. This is because the expense was already taken when creating or adjusting the allowance.

What is the allowance for doubtful accounts on the balance sheet quizlet?

True, The Allowance for Doubtful Accounts is a contra-asset account with a normal credit balance. It is shown on the balance sheet as a deduction from accounts receivable to reflect the expected amount of uncollectible accounts.

It can help your business reduce bad debt by prioritizing collections from high-risk customers, automating dunning processes, and providing real-time data and analytics. It also cuts down the invoicing costs, and reduces payment friction and DSO to eventually lower your allowance for doubtful accounts and bad debt expense. They are the accounts receivable aging method and percentage of sales methods. Then, the company establishes the allowance by crediting an allowance account often called ‚Allowance for Doubtful Accounts‘. Though this allowance for doubtful accounts is presented on the balance sheet with other assets, it is a contra asset that reduces the balance of total assets.

Method 1: Accounts receivable aging

It can also show you where you may need to make necessary adjustments (e.g., change who you extend credit to). If a customer purchases from you but does not pay right away, you must increase your Accounts Receivable account to show the money that is owed to your business. In some scenarios, there https://www.bookstime.com/ is a chance that a customer is unable to pay, and their AR is written off as bad debt. In such cases, the business must first debit its AR account and credit its allowance for doubtful accounts. Accounts receivable aging is a more precise method to calculate the allowance for doubtful accounts.

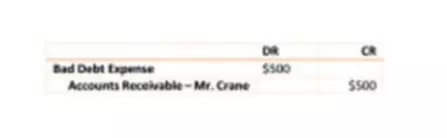

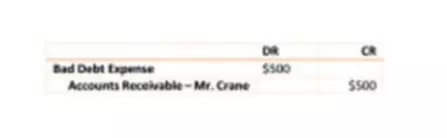

The journal entry for the Bad Debt Expense increases (debit) the expense’s balance, and the Allowance for Doubtful Accounts increases (credit) the balance in the Allowance. The allowance for doubtful accounts is a contra asset account and is subtracted from Accounts Receivable to determine the Net Realizable Value of the Accounts Receivable account on the balance sheet. In the case of the allowance for doubtful accounts, it is a contra account that is used to reduce the Controlling account, Accounts Receivable. The company can recover the account by reversing the entry above to reinstate the accounts receivable balance and the corresponding allowance for the doubtful account balance. Then, the company will record a debit to cash and credit to accounts receivable when the payment is collected.

What are the industry benchmarks for allowance for doubtful accounts?

The accounts receivable aging method is a report that lists unpaid customer invoices by date ranges and applies a rate of default to each date range. The bad debt expense is entered as a debit to increase the expense, whereas the allowance for doubtful accounts is a credit to increase the contra-asset balance. The second method of estimating the allowance for doubtful accounts is the aging method. All outstanding accounts receivable are grouped by age, and specific percentages are applied to each group. So far, we have used one uncollectibility rate for all accounts receivable, regardless of their age. However, some companies use a different percentage for each age category of accounts receivable.

What is provision for doubtful debts in P&L?

This provision is created by debiting the Profit and Loss Account for the period. The nature of various debts decides the amount of Doubtful Debts. The amount so debited in the Profit and Loss Account and an Account named “Provision for Doubtful Debts Account” is credited with the amount.

Your accounting books should reflect how much money you have at your business. If you use double-entry accounting, you also record the amount of money customers owe you. HighRadius Collections Software automates and optimizes the credit & collections management process to improve collector efficiency, minimize bad debt write-offs, improve customer relationships, and reduce DSO.

Company

The result is a more efficient collections team that contributes to enhanced cash flow and reduced DSO. In that case, the allowance for doubtful accounts will be debited, and accounts receivable will be credited. However, the net AR doesn’t get affected, and only the remaining allowance reduces from $15,000 to $5,000.